We have long become accustomed to the concerns expressed in the letter pages of local newspapers or on various online forums from those members of the public forced (if fortunate to have access to a car) to drive greater distances, or to make alternative and more costly arrangements, to access services such as health, educational, shopping and leisure facilities.

For at least some of these services, politicians and decision makers within different levels of government can often be held directly accountable for making decisions that are more than likely inconveniencing their residents in these ways. In the case of bank branch closures however, the decision to implement change is mostly taken out of the hands of politicians and is made by those not directly accountable to the wider public. Indeed, evidence by stakeholders to a House of Commons committee looking into financial services in Scotland during 2019 widely criticised the impact assessment procedures in place as being largely ineffective in involving the public in the decision to close a local bank branch. Only after a decision has been made do these processes kick in, and then primarily only to identify alternative forms of banking provision that may be available locally.

The lack of consultation with consumers prior to closure announcements was highlighted during similar enquiries conducted by the relevant committees of both the National Assembly for Wales and the Scottish Parliament. The ‘fait accompli’ nature of the decision made, and the fact that banks have reversed these decisions in only a handful of cases, have led some to question whether existing processes are robust enough to protect customers from the impacts of service withdrawal. Of course, banks point to the lack of footfall, the increased take-up of mobile banking and the provision of alternatives to branch services (post offices, ATMs) as the underlying reasons for these closures.

The question remains however as to the level of confidence the public can have that decisions are being made with their interests at heart, or indeed that the wider impacts on the social and economic sustainability of communities have been fully considered. In theory, this should include the impacts not only on individual consumers, and in particular those sections of the community likely to be most dependent on services, but extend to include wider concerns such as the vitality of town centres, the viability of the high street and lost tourism opportunities following bank branch closures.

As the list of small to medium size towns in Wales without a physical branch becomes ever longer (including, as of June 2020, Aberaeron, Newcastle Emlyn, Machynlleth and Llanidloes), there is scope for a more rigorous assessment of the implications of branch closure programs on wider patterns of geographical access. In a recent paper, published in the Journal of Applied Spatial Analysis and Policy (Langford et al., forthcoming), we model the geographical implications of bank branch closures in terms of the extra distance needed to travel to access a branch in the event of the current nearest branch closing. Such modelling exercises could help re-assure the public that the implications of changes in banking services have been fully considered prior to any announcement of closures.

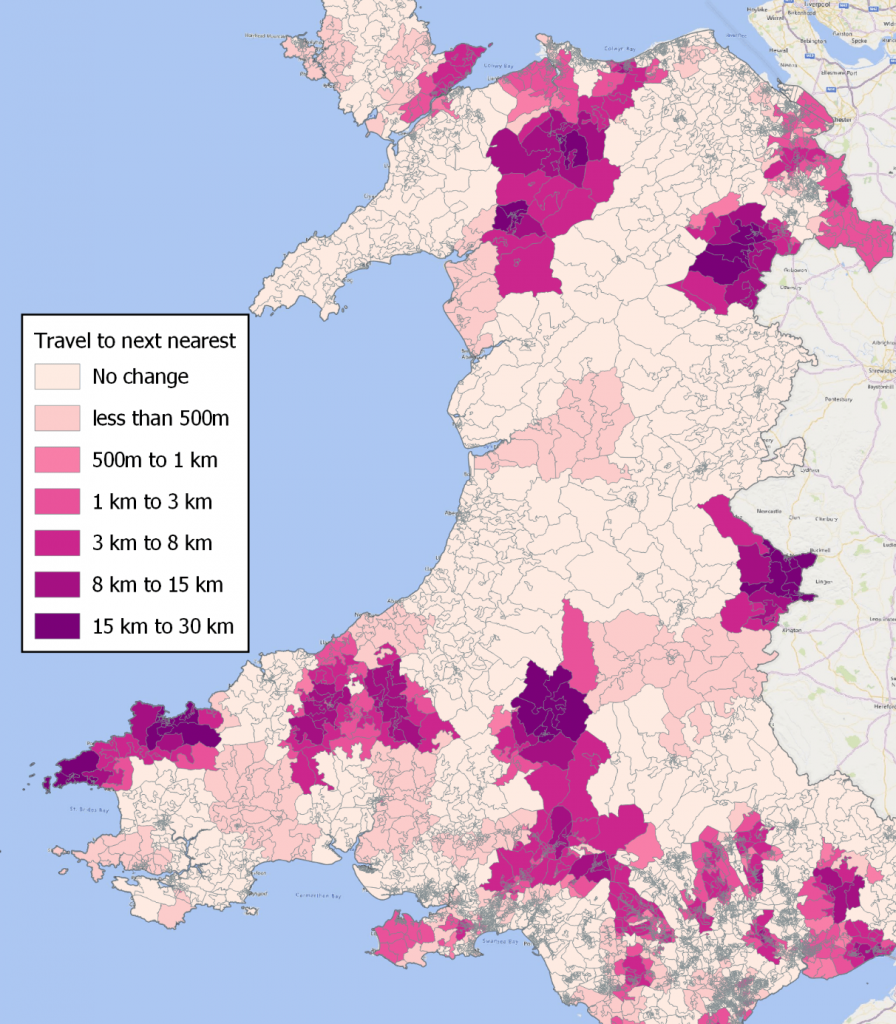

Whilst often perceived as mainly a ‘rural’ problem, our analysis suggests this is too simplistic; urban areas and valley towns are just as likely to be vulnerable to service closures. Figure 1 shows the type of mapping that could be useful in these regards; it reports extra travel distance in a future scenario if the current nearest branch were to close. It must be acknowledged at this stage that people living in those areas shown as having no change, or little extra travel, may already be travelling a very long way to reach a bank. As such they may not be impacted greatly by the closure of their nearest bank, but this does not necessarily imply that they currently have what might be regarded as ‘good access’ to banking. However, for those communities in Wales where currently the nearest branch is the last bank in town, and the next nearest bank is a long way away, the potential impact of closure can be demonstrated using these models in order to show spatial patterns under different scenarios.

Figure 1: Map of extra distance needed to be travelled to access a bank branch if the current nearest branch were to close

The importance of mapping changes in banking provision was highlighted as a key recommendation of the National Assembly for Wales Economy, Infrastructure and Skills Committee 2019 report on Access to Banking. However, we suggest this should go beyond using maps that show ‘before’ and ‘after’ scenarios to encourage the wider use of spatial analytical tools to predict the impact of bank branch closures, examining the potential consequences of decisions before they are made and potentially strengthening existing impact assessment procedures

The use of ‘what-if’ scenarios will be all too familiar to users of geographical information systems (GIS) and our study provides examples of the types of approach that could be used to examine the future implications of decisions. This latest analysis builds on our use of such tools to examine changes in other types of infrastructure (libraries, public transport, health facilities, childcare) but also extends the analysis to consider a fuller range of options that can be used to gauge the specific impacts of changes in financial services.

We recognise that the potential increase in geographic distances needed to access services is but one of the many considerations that should be included in an examination of changing patterns of financial exclusion. However spatial analytical tools can play a key role as part of a more rigorous set of impact assessment tools used to examine the implications of branch closures on communities before the decision to close a bank is actually made.

Only then will the general public have faith that banks have considered all available options and fully examined the likely consequences of their decision, or at least attempted to ensure that the needs of the most disadvantaged members of society are addressed with appropriate compensatory measures. Surely loyal customers, particularly those most reliant on their services, deserve to know that the projected standards of services that could follow such closures have been thoroughly modelled and can be defended in a more rigorous and transparently objective way than is currently the case.

Mitch Langford and Gary Higgs

GIS Research Centre, Wales Institute of Social and Economic Research, Data and Methods (WISERD), Faculty of Computing, Engineering and Science, University of South Wales, Pontypridd, CF37 1DL, UK

References

House of Commons Scottish Affairs Committee (2019) Oral evidence: Access to Financial Services

(Last accessed 14th July 2020)

Langford, M., Higgs, G. and Jones, S. (forthcoming) ‘Understanding spatial variations in accessibility to banks using variable floating catchment area techniques’, Applied Spatial Analysis and Policy, https://rdcu.be/b5yDX

National Assembly for Wales Economy, Infrastructure and Skills Committee (2019) Access to Banking, National Assembly, Cardiff. Available from www.assembly.wales/SeneddEIS

(Last accessed 14th July 2020).